Tracked My Weekend Spending for 3 Months: This App Cut My Waste by Half

Spending weekends should feel joyful, not stressful. Yet how many times have you looked back and wondered, “Where did all that money go?” I felt the same—until I started tracking my weekend habits with a simple app. What I discovered surprised me: small, mindless choices were adding up fast. This isn’t about cutting out coffee or fun—it’s about clarity. With just a few taps, I gained control, saved money, and actually enjoyed my weekends more. Let me show you how.

The Weekend Money Leak: What We Don’t Notice

Weekends are supposed to be our time—time to relax, reconnect with family, or just breathe. But somewhere between grocery runs, school events, and trying to squeeze in a little fun, our wallets start to whisper, “Wait, what just happened?” I didn’t think much of it at first. I’d grab a smoothie on the way to my daughter’s soccer game. Pick up a few things at the store “while I was there.” Order takeout because cooking after a long week felt like too much. Harmless, right? But when I added it all up mentally, I realized I was spending over $150 every weekend—without even noticing.

What shocked me most was that none of it was extravagant. No designer bags, no fancy dinners out. It was the little things: a $7 latte here, a $12 app fee there, a last-minute Amazon purchase because I “needed” new shower curtains. And because weekends feel like a break from routine, we let our guard down. We’re not clocking in or following a schedule, so our spending becomes automatic. It’s not that we’re careless—it’s that we’re relaxed. And that’s exactly when small leaks turn into big losses.

I remember one Saturday when I spent $80 without buying a single thing I truly needed. I bought a salad for lunch, picked up a birthday gift I forgot, paid for parking at the mall, grabbed a coffee while waiting, and then ordered dinner delivery because I was too tired to cook. Each decision felt fine in the moment. But later, looking back, I felt a quiet frustration. Where did the joy go? And why did I feel more drained than refreshed? That’s when I realized: the problem wasn’t spending money—it was spending without awareness. And that’s where everything changed.

Why Awareness Comes First: Seeing the Full Picture

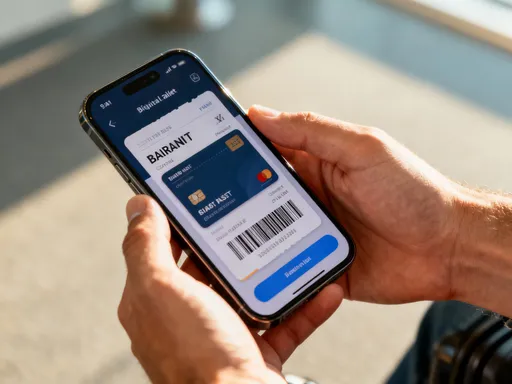

You can’t fix what you don’t see. That’s the simple truth I learned. So I decided to stop guessing and start observing. For three weekends, I didn’t change anything—I just tracked every single expense. I used a popular spending tracker app that linked to my bank account and automatically recorded purchases. No manual entry, no stress. Just real-time data. At first, I was curious. Then, I was stunned.

The app sorted everything into categories: food, shopping, subscriptions, transportation, and more. It showed me colorful pie charts and weekly summaries. And there it was, in black and white: dining out wasn’t my biggest expense. Neither was shopping. It was delivery fees, convenience charges, and digital subscriptions I forgot I had. I was paying $9.99 a month for a meditation app I hadn’t opened in six months. Another $4.99 for a photo editing tool I used once. And delivery apps? They added an average of $18 per weekend just in service and tip fees—on top of the food cost.

Seeing it all laid out changed everything. It wasn’t about shame or restriction—it was about clarity. I finally understood where my money was going, and more importantly, how it made me feel. I realized I didn’t miss most of those things. I didn’t miss the stress of checking my balance on Sunday night. I didn’t miss the guilt of overspending on things that didn’t matter. What I wanted was peace. And the app gave me that by showing me the truth—not with judgment, but with kindness. It was like having a calm, wise friend say, “Hey, you might want to look at this.”

This is the power of awareness. When we see our habits clearly, we don’t need rules or punishments. We naturally start making better choices. I didn’t need a strict budget—I just needed to know. And once I did, the changes started to happen on their own.

Choosing the Right Tool: Simplicity Over Features

Not every app is right for every person. I learned that the hard way. At first, I tried a few different ones—some with fancy dashboards, gamified rewards, or daily budget alerts. One even sent me a sad emoji when I overspent. Cute? Maybe. Helpful? Not at all. It felt like being scolded by a robot. Another required me to manually enter every purchase, which I quickly stopped doing. Life is busy enough—I didn’t need another chore.

Then I found the one that worked: an app that synced automatically, categorized purchases instantly, and sent me a simple Sunday evening summary. No pressure. No nagging. Just a clean, clear picture of my weekend. It showed me totals, trends, and even compared my spending to previous weeks. But what I loved most was how quiet it was. It didn’t scream at me. It didn’t guilt-trip me. It just showed me what happened—and let me decide what to do next.

Here’s what I learned about choosing the right tool: simplicity wins. Look for automatic syncing with your bank or card. That’s non-negotiable. If you have to remember to log things, you won’t. The app should categorize purchases on its own—food, shopping, bills, etc.—so you don’t have to think about it. Visuals matter too. A simple chart or color-coded breakdown helps you see patterns fast. And privacy? Absolutely essential. I made sure the app used bank-level encryption and didn’t sell my data. I wasn’t just tracking spending—I was trusting this app with my financial life.

I also avoided apps that felt like they were trying too hard. Gamification—like earning points for staying under budget—felt childish. Strict alerts that said “You’ve exceeded your limit!” felt stressful. I didn’t want a drill sergeant. I wanted a gentle guide. The best tech tools don’t shout; they support. They don’t complicate; they clarify. And that’s exactly what this one did.

Making It a Habit: Effortless Tracking That Sticks

The app didn’t change my life overnight. What changed it was the habit I built around it. Every Sunday night, after the kids were in bed and I’d poured myself a cup of tea, I spent five minutes reviewing the weekend. I’d open the app, glance at the summary, and ask myself one simple question: “Did my spending match my values?” That’s it. No grading. No punishment. Just reflection.

At first, I’d cringe at some answers. “No, I don’t value paying $16 for delivery when I could’ve cooked at home.” Or “No, I don’t care about that app I haven’t used in months.” But over time, something shifted. I started making different choices—before the spending happened. I’d be about to tap “order now” on a food app and pause. “Will I look at this on Sunday and wish I hadn’t?” More often than not, I’d close the app and heat up leftovers instead. Not because I had to—but because I wanted to.

One real conversation I had with myself: “I’m tired. I don’t want to cook.” True. “But will ordering out make me feel better tonight—or worse on Sunday?” Hmm. “What if I just make scrambled eggs and toast? That’s fast.” And you know what? It worked. I started feeling proud of the small wins. Not because I was saving money—though I was—but because I was making choices that felt aligned. That’s the difference between restriction and intention. One feels heavy. The other feels free.

Timing matters too. I chose Sunday night because it gave me space to reflect before the week began. If I’d done it on Monday morning, I’d be rushing. If I’d done it mid-week, I’d forget the weekend details. But Sunday night? Quiet. Calm. Mine. And over three months, that five-minute ritual became something I looked forward to. It wasn’t a chore—it was a moment of clarity.

Saving Without Sacrifice: Enjoying More by Spending Less

Here’s the best part: I didn’t have to give up the things I love. I still go out with friends. I still treat myself. I still enjoy convenience when it’s worth it. But now, I do it with purpose. The app helped me see that I value experiences far more than stuff. So I kept my budget for weekend hikes, movie nights, and coffee with friends—but I cut back on things I didn’t even notice I was paying for.

One small change made a big difference: cooking just one extra meal at home each weekend. That’s it. Instead of ordering out Friday night, I started planning a simple dinner—pasta, salad, something easy. That one shift saved me about $60 a month. And you know what? I didn’t miss the takeout. In fact, I started enjoying those quiet family dinners more. We talked. We laughed. We didn’t rush. It became a ritual I looked forward to.

I also started using tools I already had. The app showed me I had $45 in unused loyalty points at my favorite grocery store. I’d forgotten about them! I used them on a big weekend shop and felt like I got a little gift from past me. I also began packing snacks before outings—apples, granola bars, water—so I wouldn’t spend $8 on a bottle of water at the park. These weren’t sacrifices. They were upgrades. I was spending less but living more.

And when I did spend, I spent better. I chose places that offered value—like restaurants with happy hour deals or parks with free weekend events. I planned ahead instead of reacting in the moment. That’s the power of insight: it doesn’t take away joy—it redirects it. I wasn’t limiting my weekends. I was enhancing them.

Sharing the Insight: How It Improved My Relationships

One unexpected benefit? My relationships got better. I was more honest, more present, and more creative with how I spent time. When a friend invited me to brunch, I’d say, “I’d love to, but I’m trying to be more mindful with spending. Can we meet for coffee instead?” Or “I’d love to host this weekend—how about a potluck at my place?” Most people didn’t care. In fact, they appreciated the honesty. Some even said, “I’ve been feeling that way too.”

We started having game nights at home. Movie marathons. Backyard picnics. And you know what? We connected more. Without the noise of restaurants or the pressure of spending, we actually talked. We laughed. We remembered why we liked each other in the first place. One friend even asked me about the app. “Can it really help?” she said. I showed her how it worked, and now she uses it too. We even compare weekly summaries—playfully, not competitively. It’s become a little bond between us.

I also became more generous. When I wasn’t stressed about money, I had more emotional space to give. I hosted my niece’s birthday party at home with handmade decorations and a cake from the grocery store. It cost half of what a party place would’ve, and it felt more personal. The kids had a blast. My sister said, “You made it feel special without the price tag.” That meant more than any expensive venue ever could.

Financial awareness didn’t isolate me—it brought me closer. It taught me that connection doesn’t require spending. It requires presence. And when we stop worrying about money, we can finally be present with the people we love.

The Bigger Win: Calm, Confidence, and Freedom

After three months, the app showed a clear result: I’d cut my weekend spending waste by over 50%. But the real win wasn’t in the numbers. It was in how I felt. I walked into each weekend with calm instead of anxiety. I made choices with confidence instead of guilt. I spent with intention instead of impulse. And for the first time in years, I felt truly in control.

That sense of peace didn’t just stay in my wallet—it spilled into everything. I was more patient with my kids. More present with my partner. More generous with my time. I started planning little things, like a spring garden or a weekend trip, because I knew I could afford it. I wasn’t just saving money—I was building a life I loved.

This app didn’t change me. It revealed me. It showed me that I’m more thoughtful, more capable, and more in tune with what matters than I realized. And it reminded me that technology, when used mindfully, isn’t cold or complicated. It can be warm. It can be kind. It can be the quiet helper that gives you back your time, your money, and your peace.

You don’t need a perfect budget. You don’t need to give up everything you enjoy. You just need to see. Once you do, the rest follows. So if you’ve ever looked at your weekend and wondered where the money went, I get it. And I promise: clarity is closer than you think. It starts with one tap. One glance. One honest question. And it ends with freedom—the kind that lets you truly enjoy your life, one weekend at a time.